What is Fintech: The Guide to do Your Financial Management and Investment in 2023

Fintech, or Financial Technology, is now growing bigger worldwide. As we mentioned on our blog about the “Top 5 Most-Funded Fintech Companies,” the total number is 144,586 companies and startups. We can see founders at startups and CEOs of companies know the future of Fintech is bright.

Fintech is combining tech and finance. So, Fintech can open many opportunities, good and bad. In the past and until now, there have been a lot of illegal fintech companies creating scandals. Many people invest in the wrong things and get significant losses—more profound knowledge is a must to know the promising Fintech for your financial management and investment.

What is Financial Technology?

Financial Technology or Fintech is a technology that provides financial services with more straightforward usage to customers. Fintech gives practical, efficient, and also economical services. Fintech services provide businesses with various options for payment, such as credit cards, debit cards, and digital wallets.

Financial technology—FinTech for short—describes the evolving intersection of financial services and technology. The term can refer to startups, technology companies, or even legacy providers. The lines are blurring, and it’s getting harder to know where technology ends and financial services begin.

-PwCFinTech

Based on development

https://regtechone.co/en/the-history-and-evolution-of-the-fintech-industry/

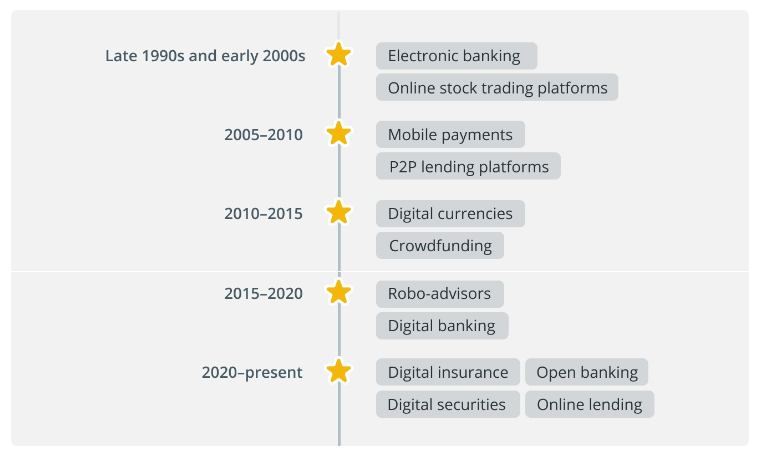

Fintech fraud started lately when digital insurance, digital security, and open lending were invented. The fintech industry has many types, like electronic banking, online stock trading platforms, mobile payment, P2P lending platforms, digital currencies, crowdfunding, Robo-advisors, digital banking, electronic insurance, digital securities, open banking, and online lending. Better knowledge is essential to decide to put money and do financial management.

Financial Technology Industries and Companies

Electronic Banking

Electronic banking fintech industry provides online banking services in electronic banking for financial transactions and account monitoring. The companies that offer this service are Wells Fargo and Citibank.

Online Stocks Trading Platform

Online stocks trading platform fintech industry is to trade stocks online—the business for this industry includes E-Trade and Charles Schwab.

Mobile Payment

Mobile payment fintech industry is a system for accepting credit cards that small companies can do VIA mobile devices. The company using this industry is Square.

P2P Lending Platform

P2P lending platform fintech industry can connect investors and borrowers without the need for traditional institutions. The platform is Lending Club.

Digital Currency

Digital currency fintech industry is to store and transfer value, disrupting traditional finance to customers. The first currency to know is Bitcoin, but we also see the rise of Cryptocurrency.

Crowd Funding

Crowd funding fintech industry is a community fundraising as a social program initiative. The first crowdfunding platform is Kickstarter.

Robo-Advisor

This fintech industry uses algorithms and automation to manage portfolios and provide personalized investment advice for individual investors. For examples, there are Betterment and Wealthfront, but now we can find around investment applications using AI.

Digital Banking

Digital banking fintech industry is similar to electronic banking, but digital banking is broader, referring to any electronic banking, such as Monzo, N26, and Revolut.

Electronic Insurance

This fintech industry provides insurance services with online-based tools and platforms that use technology to help customers while improving internal operations. The company for this industry is Lemonade.

Digital Securities

Digital securities fintech industry secures investment, removes barriers investors encounter, and streamlines the entire security process from issuance to oversight. Companies are Coinbase, Bakkt, and Paxos.

Open Banking

Open banking fintech industry provides APIs and infrastructure secure financial access and data, enabling innovation in the fintech industry. A company with an open banking Fintech industry is Plaid.

Open Lending

Open lending fintech industry provides automated lending services to auto lenders specializing in loan analytics, risk-based pricing, and risk modeling. Companies that use the online lending fintech industry are Affirm and Afterpay.

How Does Financial Technology Work?

Fintech technology is used to augment, streamline, digitize, or disrupt traditional financial services. It refers to software, algorithms, and applications, and in some cases, it includes hardware, like internet-connected piggy banks. Fintech platforms enable run-of-the-mill tasks like depositing checks, moving money between accounts, paying bills, or applying for loans. It can also apply to companies and services utilizing AI, big data, and encrypted blockchain technology to facilitate highly secure transactions amongst an internal network.

How To Know Secured Financial Technology?

Utilize Cybersecurity

Fintech should utilize its cybersecurity, such as encryption, multi-factor authentication, firewalls, and intrusion detection systems, to monitor and block threats. If they do not utilize cybersecurity, they might not realize that hackers can exploit system weaknesses to access all information and use it for financial fraud and data theft.

Proof of the data breach

https://relevant.software/blog/cybersecurity-in-fintech/

Regulated and Unregulated

It is also important to note that fintech platforms remain largely unregulated, particularly in cryptocurrencies and blockchain technologies. Therefore, it is essential to exercise caution when engaging with them.

Conclusion

The fintech industry is enormous and vital. Also, we can see the improvement and development. But still, as the user, we can manage our goals. Firstly, ask about the purpose of using Fintech, then order it to be the best for you. If you want to invest, ensure it’s regulated, and check the APIs and cybersecurity. If not, then the risk is yours.