Top 5 Most-Funded Fintech Companies

The fintech industry is growing very rapidly as more and more companies are leveraging technology to create more innovative financial products and services.

Fintech companies make technology a new color to save, invest and borrow money quickly and more efficiently. They also use technology to create new ways to pay for goods or services. The fintech industry is changing the way things work, with everyone able to track their finances, and is revolutionizing the financial services sector.

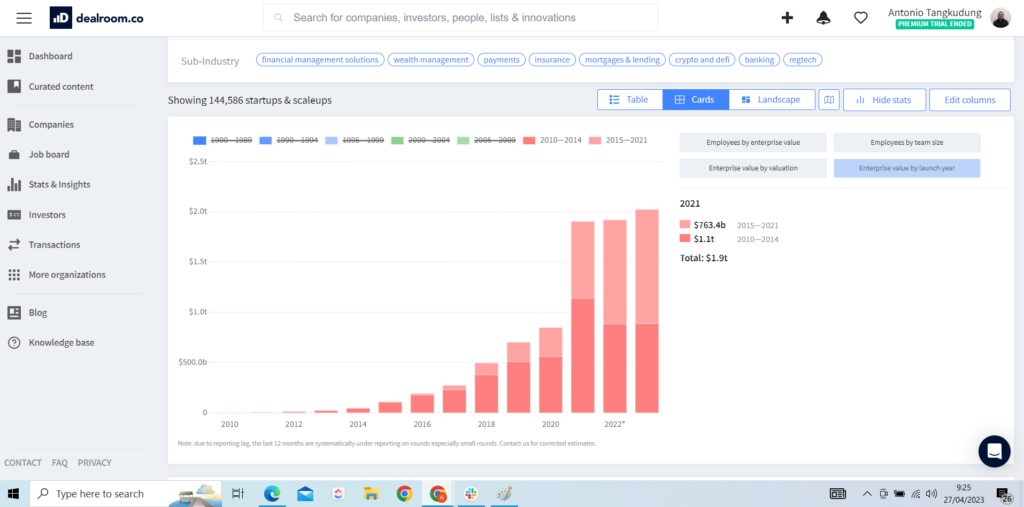

Analysis of Global Data on Total Fintech companies

From the Dealroom, a total of 144,586 registered fintech companies and 44,974 fintech companies that received funding in the last ten years show a sizable increase in Total: $1.9t of this is inseparable from how the world of the fintech industry develops. For more details about the development of the fintech industry, we have discussed it in the previous article.

There are several industrial fintech companies that receive the largest funding according to the Dealroom.

Fintech companies that get the biggest investment in the world

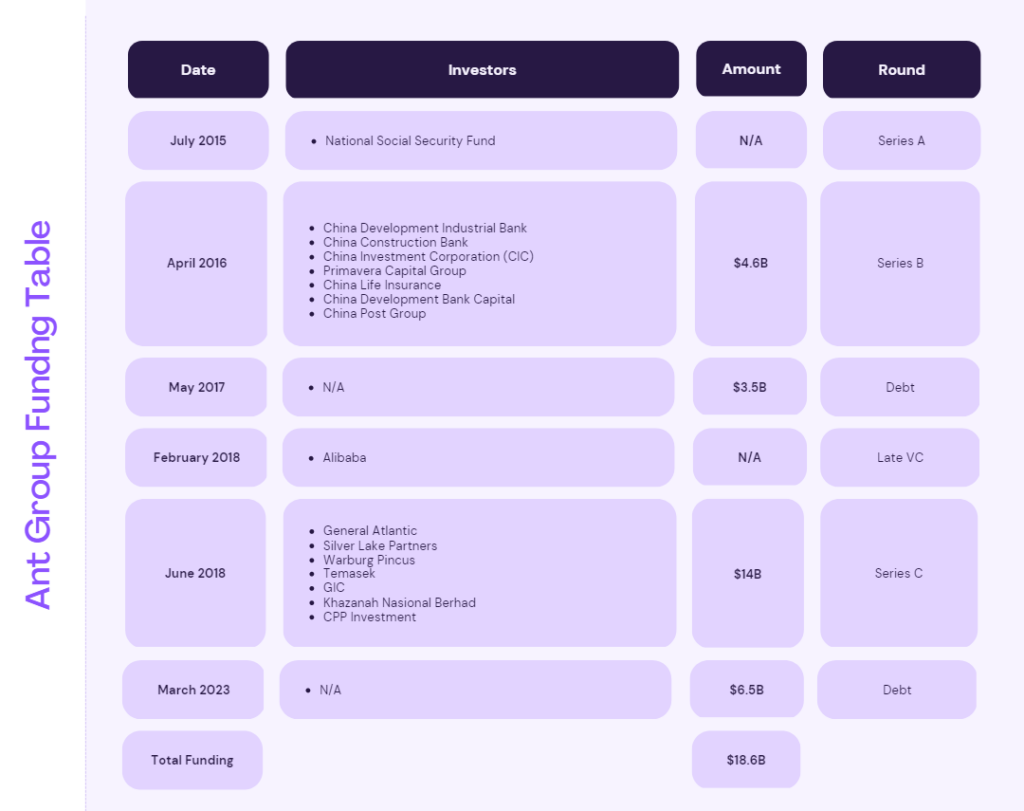

1. Ant Group: $14.0B (with total funding $18.5B)

Ant Group was founded in 2004 to create trust between online sellers and buyers. Over the years, Ant Group has grown to become one of the world’s leading open Internet platforms. As for the list of technology services used to build and run applications base on data from Dealroom

- Nginx

- Tengine

- Jquery.

Through technological innovation, we support our partners in providing consumers and SMEs with an inclusive and convenient digital life and digital financial services. In addition, we have introduced new technologies and products to support the industry’s digital transformation and facilitate collaboration. Working with global partners, we enable merchants and consumers to make and receive payments and send them around the world.

At the moment its total funding is $18.5 billion the last round they got was on $6.5 billion in debt in 2023 Q’1. Largest number of funding is $14.0B in June 2018 with Series C round. The list of investors:

Alipay, one of Ant Group’s products, has over 1 billion annual users and 711 million monthly active users.

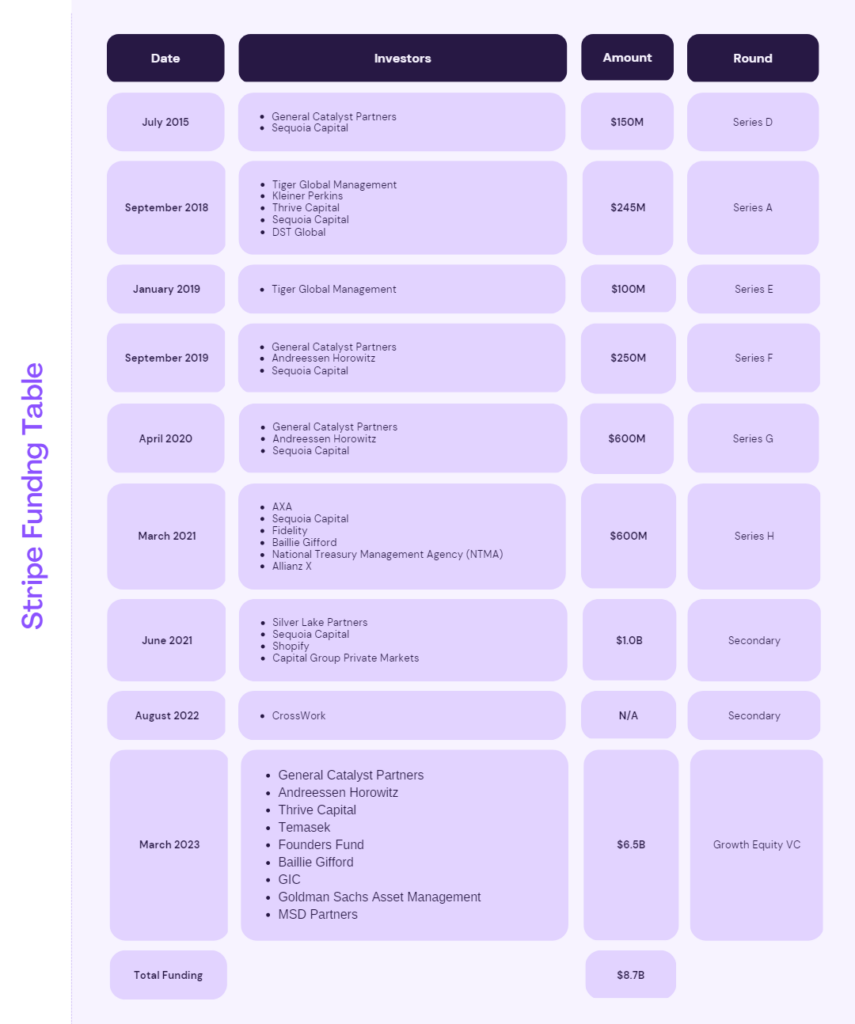

2. Stripe: $6.5B (with total funding $8.7B)

Stripe is a fintech company that develops a payment processing platform, which includes APIs (application programming interfaces) and software as a service (SaaS) packages that enable payments to be made digitally.

Its API enables web and mobile application developers to integrate payments (receiving and sending) into conducting daily business. Basically, the Company was founded in 2010 by Irish brothers Patrick and John Collison. That same year he entered the startup accelerator program Y Combinator.

The Stripe Mission Statement:

Our mission is to increase the GDP of the internet. Stripe is a technology company that builds economic infrastructure for the internet. Businesses of every size—from new startups to public companies—use our software to accept payments and manage their businesses online.

As for the list of technology services used to build and run applications base on data from Dealroom.

- Nginx

- Node.js

- PHP

- Docker

- go

- Kubernetes

They started in 2010 and the total funding is $8.7B. Last round they get is from Growth Equity VC in total of $6.5B in 2023 Q’1. Largest number of funding is $6.5.B in March 2023 with the Growth Equity VC round. The list of investors:

- General Catalyst Partners

- Andreessen Horowitz

- Thrive Capital

- Temasek

- Founders Fund

- Baillie Gifford

- GIC

- Goldman Sachs Asset Management

- MSD Partners

Stripe has 1 million + customers, ranging from small startups to the largest and most innovative corporations worldwide. Customers include Amazon, Shopify, Pelaton, Lyft, Zoom, Slack, Uber, Doordash, and OpenTable.

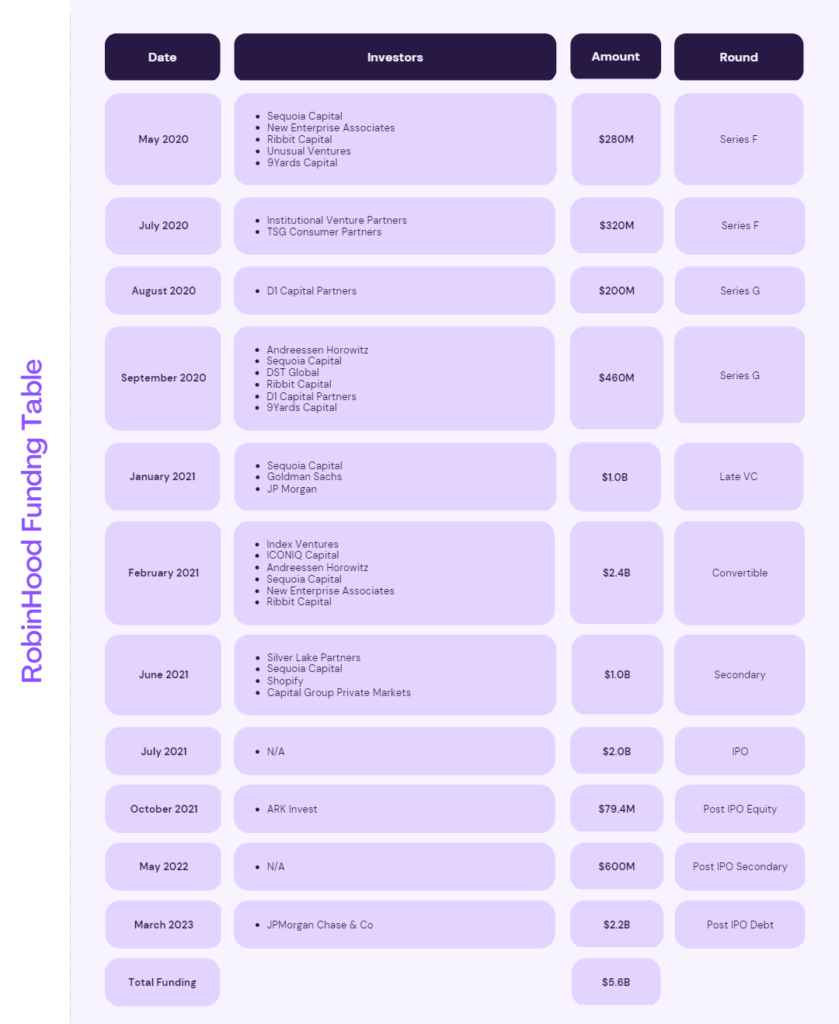

3. RobinHood: $2.2B (with total funding $5.6B)

Robinhood is poised to offer more products to its 20+ million users. Future services may include retirement accounts, banking services, and credit cards.

As for the list of technology services used to build and run applications base on data from Dealroom.

- Django

- Kubernetes

- Mariadb

- Redis

- AWS

Provided with the prediction stock, if Robinhood stock is forecasted to return an average of 10% per year, we can find the future price based on today’s latest trade value. We can see how the company perform:

They started in 2013 and the total funding is $5.6B. Last round they get is from Post IPO Debt in total of $2.2B in 2023 Q’1.

Largest number of funding is $2.4B in February 2021 with Convertible round. The list of investors:

- Index Ventures

- ICONIQ Capital

- Andreessen Horowitz

- Sequoia Capital

- New Enterprise Associates

- Ribbit Capital

Robinhood is poised to offer more products to its 20+ million users. Future services may include retirement accounts, banking services, and credit cards.

Robinhood is a Silicon Valley startup that revolutionized online investing by offering a commission-free trading platform. Popular with younger investors, you can place unlimited stock, bond, or crypto-currency trades on the Robinhood app and pay no fees.

4. Paytm: $2.5B (with total funding $5.2B)

Paytm is an Indian multinational technology company specializing in digital payment systems, e-commerce and financial services, based in Noida. They started in 2009 and the total funding is $5.2B. Last round they get is from IPO in total of $2.5B in 2021 Q’4.

Largest number of funding is $1.4B in May 2017 with Late VC round. The investor is SoftBank.

As for the list of technology services used to build and run applications base on data from Dealroom.

- Node.js

- Docker

- kubernetes

- Selenium

- Sython

base on data Paytm Quarterly Operating Performance Update for March 2022 they have seen record growth in user engagement on the Paytm platform, with average monthly transacting users (MTU) in the fourth quarter of FY 2022 at 70.9 million.

4. JD Digits: $2.0B (with total funding $5.0B)

JD Technology (JDT) is a business group under JD.com with a focus on serving governmental and corporate clients through technology. Living up to the mission of leading technology development, upgrading cities, and promoting the digital intelligence of industries, it is committed to providing technological products and services with a root in the whole value chain to governments, enterprises, financial institutions, and other clients. Based on cutting-edge technologies such as AI, cloud computing, big data, and IoT, and drawing on the experience in the supply chain accumulated by JD, JDT has grown into a provider that has the best industry know-how, providing clients with digital and intelligent solutions based on the supply chain. They started in 2013 and the total funding is $5.0B. Last round they get is from Series B in total of $2.0B in 2018 Q’3.

Largest number of funding is $2.0B in July 2018 with Series B round. The list of investors:

As for the list of technology services used to build and run applications base on data from Dealroom.

- Nginx

- Next.js

- Nexus.js

- Vue.js

- Webpack

By the end of 2021, JD.com, a Chinese online retailer, had about 569.7 million annual active customers, which is an increase from 471.9 million in the previous year. The outbreak of coronavirus in 2020 caused a rise in e-commerce in China and resulted in more people shopping online.